|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

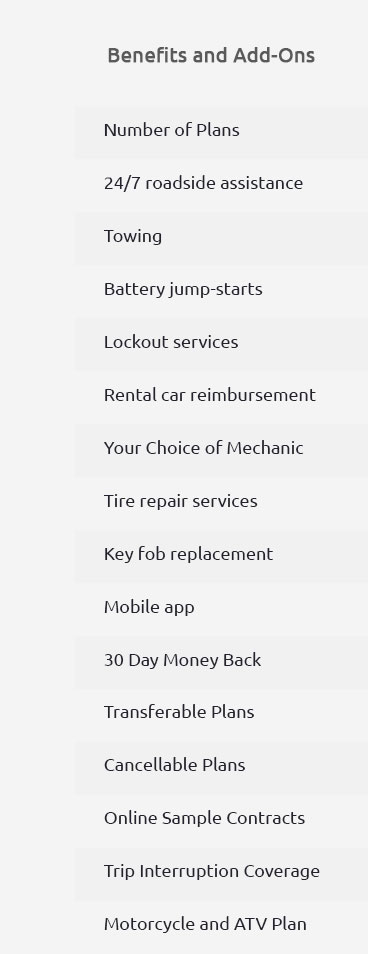

Gap Insurance Coverage: A Comprehensive GuideWhen purchasing a new or used vehicle, U.S. consumers often explore various options to protect their investment. One such option is gap insurance coverage, a smart choice for those seeking peace of mind and cost savings in the event of a total loss. But what exactly is gap insurance, and why is it essential for vehicle owners? Understanding Gap InsuranceGap insurance covers the difference between what you owe on your vehicle and its actual cash value (ACV) in the event of a total loss due to theft or accident. Without gap insurance, you might find yourself paying out of pocket to cover the balance on your auto loan. Why You Need Gap Insurance

Gap Insurance Benefits for U.S. ConsumersFor American drivers, gap insurance offers specific benefits that align with common financial needs. Whether you're financing a new SUV in Los Angeles or a compact car in New York, gap insurance can provide crucial financial protection. Extended Auto WarrantiesAlongside gap insurance, considering automobile extended warranty prices is vital for comprehensive vehicle protection. These warranties cover repair costs beyond the standard manufacturer warranty period. What Does Gap Insurance Cover?Gap insurance specifically covers the difference between your car's depreciated value and the remaining loan balance. Here's a quick breakdown:

Remember, gap insurance does not cover repairs or maintenance. For specific repair coverage, explore options like a nissan cube transmission warranty for tailored protection. FAQs About Gap Insurance CoverageWhat is the primary benefit of gap insurance?The primary benefit is financial protection, ensuring that you aren't left paying out of pocket if your vehicle is totaled and you owe more than its value. Can I purchase gap insurance at any time?Gap insurance is typically purchased at the time of vehicle financing, but some insurers offer it later. Check with your provider for specific terms. Is gap insurance necessary for leased vehicles?Yes, most lease agreements require gap insurance as the car's value can depreciate quickly, leaving a gap between the car's worth and the lease balance. https://www.thehartford.com/aarp/car-insurance/gap-insurance

Gap insurance is an optional car insurance coverage that helps pay the difference between your car's Actual Cash Value (ACV) and the amount you owe on the loan. https://www.farmers.com/learn/insurance-questions/gap-insurance-coverage/

Gap insurance is an optional coverage that helps pay off your car loan or lease if your car is totaled in an accident or stolen and you owe more than its ... https://www.statefarm.com/simple-insights/auto-and-vehicles/what-is-gap-insurance-and-what-does-it-cover

GAP insurance typically covers the difference between the remaining value of your vehicle loan or lease and your vehicle's actual cash value at the time of the ...

|